Let’s talk numbers! Today, I’ll be discussing the 5 numbers every small business owner needs to know. Do you know these numbers in your business?

When I started my photography business in 2013, I had no idea what went into running a successful and profitable business. I thought it was all about taking pretty pictures, providing my clients with a great experience and sharing my work on social media. It didn’t really register that I also needed to pay attention to the financial end of things.

At the time of starting my business, I also worked a full-time job as a Personnel Assistant for our local county. I viewed the money I brought in from photography as purely a bonus income. I didn’t think I needed to pay attention to the money coming in or out. Looking back, I have nothing to show for the amount of income I received during those early years in business. I wanted so desperately to be able to take my photography business full-time, but my financial irresponsibility held me back from doing so for many years.

I didn’t save for taxes, new equipment, or business expenses. The newest camera and lenses were put on a credit card. I needed to have the latest and greatest thing, right? I never truly new my finances at any given time, and if my business was profitable. My lack of business knowledge and financial irresponsibility was completely my fault –– and the worst part? It was completely avoidable!

According to various sources, 8 out of 10 businesses don’t make it five years.

The reason why most of them close? They don’t have a grasp on their finances. Either they didn’t have a proper cash flow plan (i.e. enough money coming in each month to cover bills), didn’t plan/save for taxes, or had a poor pricing model.

Even if you’re not a numbers person (like me!), getting control of your finances is possible! So, today I thought it would be beneficial to go over the 5 numbers every business owner needs to know in their business. These are ones that I track every month, quarter and year!

Let’s dive into the 5 numbers every small business owner needs to know, by learning what they are, why these numbers are important and how to track them!

The 5 Numbers Every Small Business Owner Needs to Know

#1

Owners Pay

The most important number, in my opinion, is owners pay (i.e. your salary). Many creative entrepreneurs go years without giving themselves a paycheck, which can eventually become detromental. When you don’t pay yourself a salary it can slow down your financial goals, paying off debt, build savings or (like in my case) it can take you longer to go full-time.

To have a better understanding of what you should be paying yourself, it all starts with a personal budget! You will need to know exactly what your personal expenses are so you can make enough to cover that. Don’t have a budget yet? Try out my favorite budgeting app –EveryDollar.com. It’s super easy to use and it connects directly with your bank!

Paying yourself is a requirement, not a luxury! It’s also a clear sign of the health of your business. Start with building your personal budget so you know exactly how much to pay yourself!

#2

Total Revenue

Total revenue or the total amount of money you brought into your business from all sources (i.e. wedding photography, print sales, album sales, mini-sessions, education/courses, etc) is an essential number to know. Calculating your total revenue can be helpful in evaluating the health of your business. The larger your total revenue, the more money your business is bringing in. This can be helpful if you have many job specific or variable expenses that need to be covered. Having a large revenue means you’ll likely have enough income to cover these expenses and the means to keep your business afloat for the foreseeable future.

At the end of each year, I will look at the services or products that were the most and least profitable. I can then make a decision on how I want to proceed on certain offerings going forward. I also compare it to my total expenses (which we will get to in a moment) and determine if I need to make adjustments to pricing to increase revenue going forward.

You can calculate total revenue any way that is easiest for you. Utilizing an accounting software, such as Quickbooks, can make calculating revenue headache free (in my opinion!).

#3

Total Expenses

Total expenses (i.e overhead or cost of goods sold) is the total amount of money going out of your business. This can be variable expenses like marketing, education, client management system, insurance, gallery/website hosting, software, supplies, or equipment purchases. It also includes job-specific expenses such as coffee at an initial consultation, outsource editing, film costs, second photographer, etc.

Having an understanding of this number will tell you quite a lot about your business;

- Are you pricing for profit? If you spend too much on a certain job and are hardly turning a profit, you either need to cut costs or increase what you charge. It’s essential you know this number so you can properly price out your goods and services.

- Are you sticking to your budget or overspending in certain categories? After setting up a monthly budget, you should be tracking your expenses weekly (if not daily) to ensure you are staying on track. If you don’t track your money, you wont know when to stop spending in a given category. At the end of each month, review and compare the expenses you tracked versus what you planned to spending. If you overspent, look for ways to cut spending in another category. If you spent too little, you might want to allocate more to another area.

- What are your spending habits? Reviewing your expenditures will help you become more aware of your spending habits. If you don’t know where your money is going, you won’t be able to recognize negative spending behaviors that you can easily change to make your money work for you. For example, you might learn you are paying monthly for a service you no longer use or you might see you are overspending on a specific service.

- Are you meeting your financial goals? It’s not enough to stick to your budget if you don’t also make strides toward important financial goals. Are you wanting to pay down debt? Save for new equipment? Start contributing to your retirement? You are more likely to achieve these goals if you budget for them, create a savings plan, and then track your spending to ensure that your spending matches your priorities.

As mentioned above, having an accounting software, like Quickbooks, makes finding this number super simple. Just run a “profit and loss” report and it will tell you all you need to know!

Tip: Make sure to have a separate business bank account to easily track those numbers!

#4

Profit

Most businesses calculate profit as revenue – expenses = profit. While it makes sense to cover expenses first, there is no guarantee you’ll make a profit using that formula.

The Profit First Formula (in which I utilize!) flips the equation giving profit the focus it deserves. Sales – Profit = Expenses. If this is a theory you’ve never heard before you may be scratching your head! The goal of using this method is to develop a system for growing your business in a sustainable way that creates long-term success.

First, account for your owners pay, taxes, and profit, and whatever is left is what the company has to spend on everything else. Sounds complicated, right? It’s actually pretty simple to do! When you begin to discipline yourself to set aside a percentage of revenue for profit and only spend what is left to cover your expenses, you’re forcing yourself to spend more wisely.

Doing that can be uncomfortable at first. It might mean you have to delay spending on growth for a short period of time. It also means when you do encounter a great opportunity to grow your revenue and profits, you’ll have the resources in your own account to do so.

So, how do you get started using this method? I highly recommend reading the book Profit First to get a full-understanding of how to implement this method into your business. Then, you’ll want to figure out your allocation percentages to cover owners pay, taxes, operating expenses, and profit. The allocation percentage will be different for everyone, but my allocations are the following:

- Owners Pay: 40%

- Operating Expenses: 35%

- Tax: 15%

- Profit: 5%

- Savings 5%

When I receive a payment for a wedding or session that amount is deposited into my income account. Every two weeks (generally the 10th and 25th of each month) I will divide up the money from the income account to each of the accounts listed above.

The profit account is essentially used as retained earnings. As that account builds, you can utilize the money in it to reinvest in your business or as a savings account for a rainy day. I review the amount in my account each month, quarter, and year to determine what I can use the funds for in the future.

At the end of the day, I want my business to be profitable. To make sure my business continues to thrive, it works much easier to take my profits out first and spend more wisely when it comes to my expenses.

#5

MINIMUM SALE REQUIREMENT

It’s important to know how many weddings, sessions and sales are needed in order to cover all your expenses (i.e. owners pay and business expenses). This analysis will tell you what you the minimum sale requirement for each of your sessions in order to cover costs.

There are a lot of numbers that go into figuring out this number. You will need to know your personal budget (how much income you personally need), variable business expenses, job-specific expenses, your tax rate, your hourly job rate, and how many weddings and/or sessions you want to take on each year.

Start out by figuring out your personal expenses so you know the amount of income you need (i.e. create a budget!). Next, figure out the variable business expenses and the job-specific expenses for the business. Then, decide how many hours you want to work each week and how many weeks you’d like to have off per year. Lastly, you’ll need to know your tax rate (a simple Google Search will help you determine this –– or talk to your accountant!).

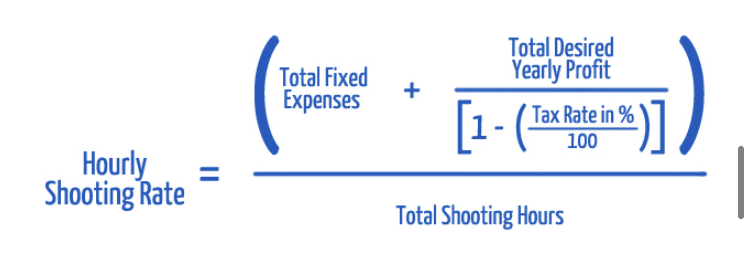

Now that you have your numbers written down for the items above, let’s do a little Math. To make sure you can cover all expenses, utilize the equation below to determine how many hours you’ll need to work this year:

# hours worked per week x # weeks worked per year

Next, determine how many hours you will be spending on each project. Don’t short change yourself here! If you’re a blogger, how many hours does it take to write a post? If you’re a photographer, how many hours will you be shooting on a wedding day? Once you have that number, utilize this calculation:

hours spent on project x # desired clients per year

Your hourly rate for your services can be figured out through a calculation. Don’t shy away from the math as it’ll help you figure out what you need to charge!

Here is the broken down version of how to calculate the above:

- Change your tax rate percentage into decimal form by dividng by 100. If you have a 25% tax rate, you’d get .25.

- Subtract that number from 1. Here we’d get 1-.25 =.75

- Take your total desired profit and divide it by the answer in step 2. If you want to make $15,000 a year in profit, take $15,000 divided by .75 and get $20,000.

- Add your total fixed expenses to the amount in step 3. So if you have $10,000 in total fixed expenses, you’d add this to $20,000 and get $30,000.

- Divide the amount in step 4 by your total shooting hours per year. For example, take $30,000 divided by 300 and the hourly shooting rate is $100.

After you’ve figured out your hourly shooting rate, you’ll need to calculate your non-shooting rate. Essentially, we’re taking the formula above and dividing it by your total hours of work per year instead of total shooting hours of work per year. Take the amount in step 4 and divide by your total hours of work per year. This will be your non-shooting rate.

Finally, let’s put it all together to figure out what you need to average for each type of session you do.

For each type of session, take the number of hours of shooting (for one session) and multiply this times your hourly rate. Next, add on the variable expenses you have for that session. This is how much you need to make on average for each type of session in order to meet your profit goals for the year before cost of goods.

It’s not too complicated to calculate your minimum requirement! Save the headache of manually calculating and use my Pricing Guide to do the hard work for you!

In Review

In review, it’s essential to have an understanding of your owners pay, total revenue and expenses, profit and minimum sales requirement so you’re working smarter and not harder. If someone would ask you about these numbers, you should be able to rattle them off without looking! All of this can be a bit overwhelming, especially if you aren’t a numbers person (like me!). If I can do it so can you!

Do you agree with my list of the 5 numbers every small business owner needs to know? What would you include? Tell me in the comments below!

add a comment

+ COMMENTS